personal property tax car richmond va

The Henrico County Treasurers Office is located at. WRIC -- Governor Glenn Younkin signed House Bill 1239 into law today which empowers localities to cut tax rates on cars and to prevent tax hikes from the rise.

Solving Richmond S Money Problem Richmondmagazine Com

If you can answer YES to any of the following questions your vehicle is considered by.

. The median property tax in Richmond County Virginia is 673 per year for a home worth the median value of 148700. All online in person or mail payments madepostmarked on or before August 5 2022 will not be subject to penalties or interest. In addition Henrico maintains a personal property tax rate for vehicles of 350 per 100 of assessed value which is the lowest among major localities in the region.

If your vehicle is valued at 18030 the total tax would be 667. This measure cost the county over 7 million. The Personal Property Tax rate is 533 per 100 533 of the assessed value of the vehicle 355 for vehicles with specially-designed equipment for disabled persons.

Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as. Board of Supervisors Approves 15 Tax Relief on Personal Property Taxes Vehicle values climbed by an average of 33 or more as of Jan 1 2022 according to the JD. The county also can.

Answer the following questions to determine if your vehicle qualifies for personal property tax relief. Cut the Vehicle License Tax by 50 to 20. Personal Property Tax also known as a car tax is a tax on tangible property - ie property that can be touched and moved such as a car or piece of equipment.

An example provided by the City of Richmond goes like this. In total the county returned 30 million to taxpayers to mitigate the increase in. If your vehicle is valued at 18030 the total tax would be 667.

Richmond County collects on average 045 of a property s. Virginias Constitution also restricts what kinds of property tax relief city council can offer to Richmond residents. Main Street -Suite 300 -Richmond VA 23219 The mailing address.

Please visit RVAgov to pay online. You cannot pay online with a credit or debit card. It is an ad valorem tax.

At the calculated PPTRA rate of 30 you. The total combined income from all sources of the taxpayer spouse and all occupants living in the home may not exceed 20000 in the year preceding the tax year for which assistance is.

Junk Car Removal R R Towing Richmond Va 804 745 8697

3018 M St Richmond Va 23223 Mls 2221312 Redfin

Used Cars Under 3 000 For Sale In Richmond Va Vehicle Pricing Info Edmunds

How To Reduce Virginia Income Tax

Chesterfield Extends Payment Deadline For Personal Property Taxes To July 29 Richmond Local News Richmond Com

New 2022 Toyota Gr Supra 3 0 Premium For Sale In Richmond Va Wz1db0c05nw048218

Personal Property Vehicle Tax City Of Alexandria Va

Richmond Raises Tax Relief As Vehicle Values Surge Wric Abc 8news

1015 W Franklin St Richmond Va 23220 Realtor Com

Solving Richmond S Money Problem Richmondmagazine Com

Drury Plaza Hotel Richmond Drury Hotels

Youngkin Signs Bill To Reclassify Certain Vehicles And Personal Property Tax Rates Wric Abc 8news

Are There Any States With No Property Tax In 2022 Free Investor Guide

City Of Richmond Va Cityrichmondva Twitter

Richmond Extends Deadline To Pay Personal Property Taxes Wric Abc 8news

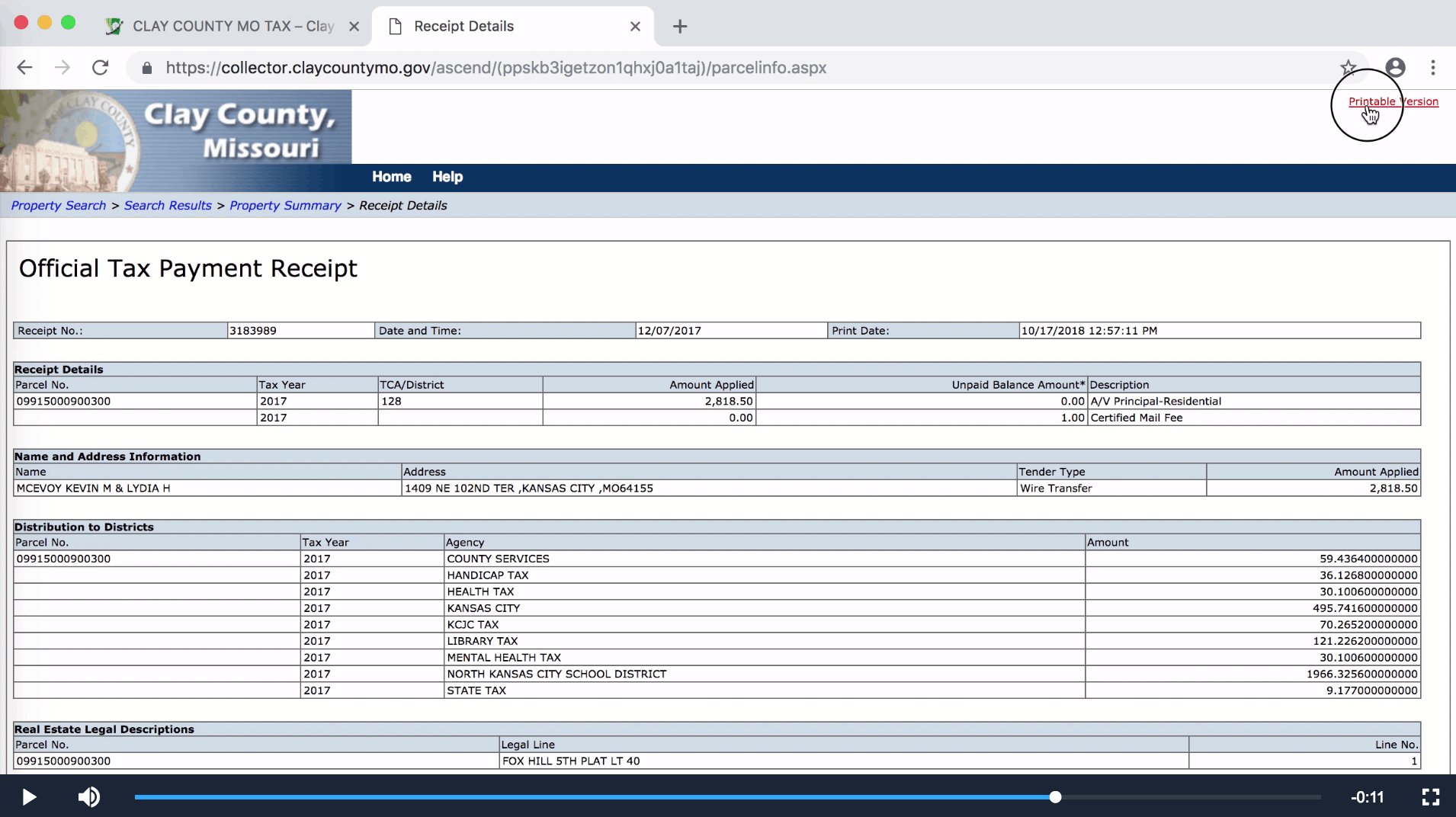

Clay County Missouri Tax A Resource Provided By The Collector And Assessor Of Clay County Missouri